Can i borrow 5 times my salary for a mortgage

So you could buy a 250000 home with a 12500 deposit. To figure your mortgage front-end ratio multiply your annual salary by 031 and.

Nationwide Increases Mortgage Borrowing To 6 5 Times Salary Money To The Masses

Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan.

. You can send us comments through IRSgovFormComments. Monthly payments mortgage PMI property taxes insurance 3393. The monarchy is a friend to all faiths.

18001 0345 300 2585. At 60000 thats a 120000 to 150000 mortgage. Petersburg Florida at various real estate meeting helping other investors new and experienced improve.

Typically you can borrow. The equity loan scheme finances the purchase of newly built houses. Im turning 18 soon but Ive not yet received a letter about my options for my maturing Child Trust Fund Well send you a Child Trust Fund Maturity Letter 20 days before your 18 th birthday.

Allister Heath 14 Sep 2022 930pm. NW IR-6526 Washington DC 20224. Are assigned zero earnings.

A married low salaried worker can receive over 100 of their salary in benefits after retiring. Financial crisis of 20072008. Can I borrow a mortgage that is worth five times my salary.

Enter your salary below combined salaries for a joint application to see how much you could potentially borrow. A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lenders have different rules and the income multiple they allow can depend on many things.

Find out what you can borrow. Luckily youve saved 50000. Debt-ceiling crisis of 2011.

For example if you borrow money and use 70 of it for business and the other 30 for a family vacation you can generally deduct 70 of the interest. As the latest RPI inflation rate was 15 interest charged from March 2022 is between 15 and 45 depending on whether youre studying or graduated and how much you earn. Lending activities can be directly performed by the bank or indirectly through capital markets.

Or 4 times your joint income if youre applying for a mortgage. Because banks play an important role in financial stability and the economy of a country most jurisdictions exercise a high degree of regulation. Possessing over fifty years of real estate investing experience Pete still teaches a couple times of year.

How much can I borrow for my mortgage. Some lenders offer up to 6 times your salary but they will be very strict about who they lend this amount to. Since you must pay a deposit of at least 5 you can afford a home worth 178950 the 170000 youll borrow plus a 5 deposit of 8950.

Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts. Why cant the Civil Service just for once pull out all the stops. 55x your salary if you earn 75K or 100K on a joint application if youve got a 15 deposit to borrow up to 2M How many times my salary can I borrow The idea that mortgage lenders use a secret salary-multiplier formula is that UK borrowers are reluctant to let go.

Mortgage lenders say that a mortgage payment should not exceed 31percent of an applicants gross monthly income. This information does not contain all of the details you need to choose a mortgage. How much can I borrow.

Bezos Amazon wages have long been set at the middle-class level of around 80000 a year. You can usually borrow around 4 to 5 times your salary. You can continue to deduct 50 of the cost of business meals if you or your employee are present and the food or beverages arent considered lavish or extravagant.

This means you could afford a home worth 220000 the 170000 you can borrow plus the 50000 youve saved. As a requirement you must make a 5 deposit and obtain a mortgage to shoulder 75 of the loan. All figures provided by our How much can i borrow mortgage calculator are an estimate only please call us to discuss your requirements in more detail.

Youll need to obtain an Illustration before you make a decision. The Bezoses of the world have no need to be paid a salary. It was technically a mortgage because it.

The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income. The sum of the highest 35 years of adjusted or indexed earnings divided by 420 35 years times 12 months per. In specific years.

How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. Ephraim Mirvis 14 Sep 2022 657pm. You can borrow a minimum of 5 and a maximum of 20 40 in London of the propertys full price.

This is rather very unlikely. Our experienced journalists want to glorify God in what we do. An MMM-Recommended Bonus as of August 2021.

However with the governments Help to Buy scheme first-time buyers can get a mortgage with a 5 deposit. In practice student loans are interest-free for many. Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross income.

Even though income hasnt been the key lending criteria for banks. If you are now 18 and you still havent received a letter then contact us on 0345 300 2585 - Relay UK. You can deduct 100 of your meal expenses if the meals are food and beverages provided by a restaurant and paid or incurred after December 31 2020 and before January 1 2023.

We provide free and independent reviews on saving investing pensions and ISAs starting a business property mortgages retirement equity release more. Or you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. How Much Mortgage Can I Afford if My Income Is 60000.

This would usually be based on 4-45 times your annual income but some mortgage lenders stretch to 5 times salary and some even higher than that. American Family News formerly One News Now offers news on current events from an evangelical Christian perspective. Pete can be found in St.

The house must also be bought from a builder recognized by the program. Ultimately your maximum mortgage eligibility is calculated by weighing your income against your debts. 1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and.

The usual rule of thumb is that you can afford a mortgage two to 25 times your income. Under this formula a person.

How Much Can I Borrow On A Mortgage Based On My Salary

Can I Borrow Five Times My Salary Mortgage House

Can You Afford A Million Dollar Mortgage In Canada Loans Canada

/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)

Pre Qualified Vs Pre Approved What S The Difference

Nationwide Offers 5 5 Times Salary Mortgages To First Time Buyers With Just 5 Deposits It Could Unlock Home Owning Dreams But What Are The Risks R Ukpersonalfinance

:strip_icc()/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

How To Increase The Amount You Can Borrow My Simple Mortgage

As A First Time Home Buyer How Much Can I Borrow Wmc

Can I Get A Mortgage With Low Income Haysto

How Much House Can I Afford Fidelity

Mortgage Deposits And Income Multiples Explained Haysto

How Many Times My Salary Can I Borrow Yescando

Bigger Mortgage Loans For Wealthy Workers Money The Times

/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

Mortgage Affordability Calculator Rbc Royal Bank

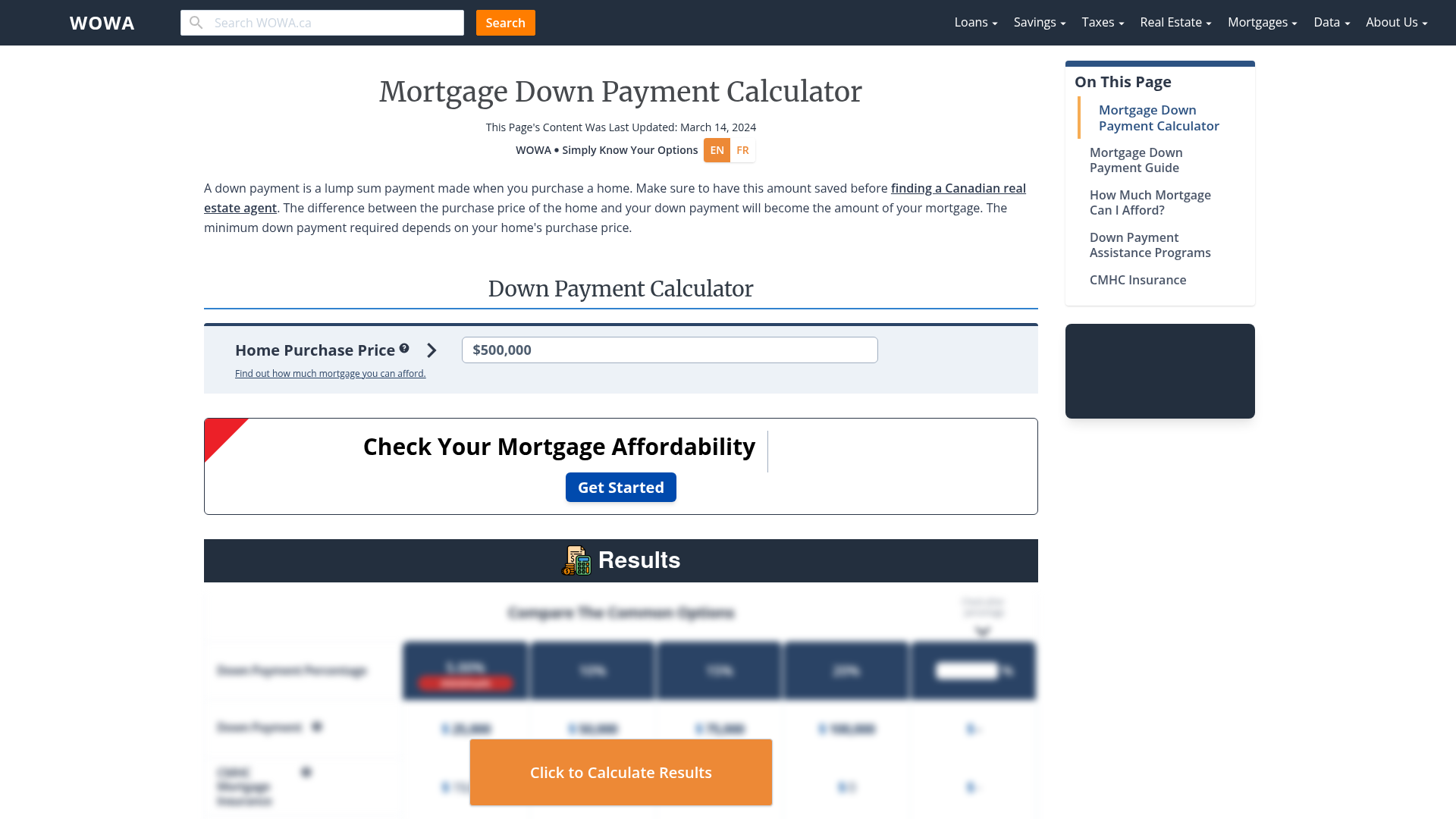

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca